Zoogla

Building financial wellbeing across the United Kingdom

The all-in-one banking tool: Manage all your accounts in one place, track your spending, transfer money globally with no hidden fees, build your credit score without the need for credit checks, save money effortlessly with the method that suits you best.

In combining all these features, Zoogla provides a simple mobile solution for previously unbanked people in the UK. We were tasked with revamping their whole app design to help create an accessible banking experience for everyone.

- Product Workshop

- iOS Native Design

- Android Native Design

- Web Design

- Responsive Design

- Design System

- Development Handover

A mobile solution for the unbanked

The all-in-one banking tool for everybody

Zoogla provides its users with a number of valuable features, such spending analytics, connecting to other bank accounts, setting budgets, creating saving pots, taking loans… And each tool can be configured and personalized to your liking. By creating a clean environment, we made sure that every user can easily find their way through the app’s many functions and quickly use them to their advantage.

Mirroring exceptionalism through design

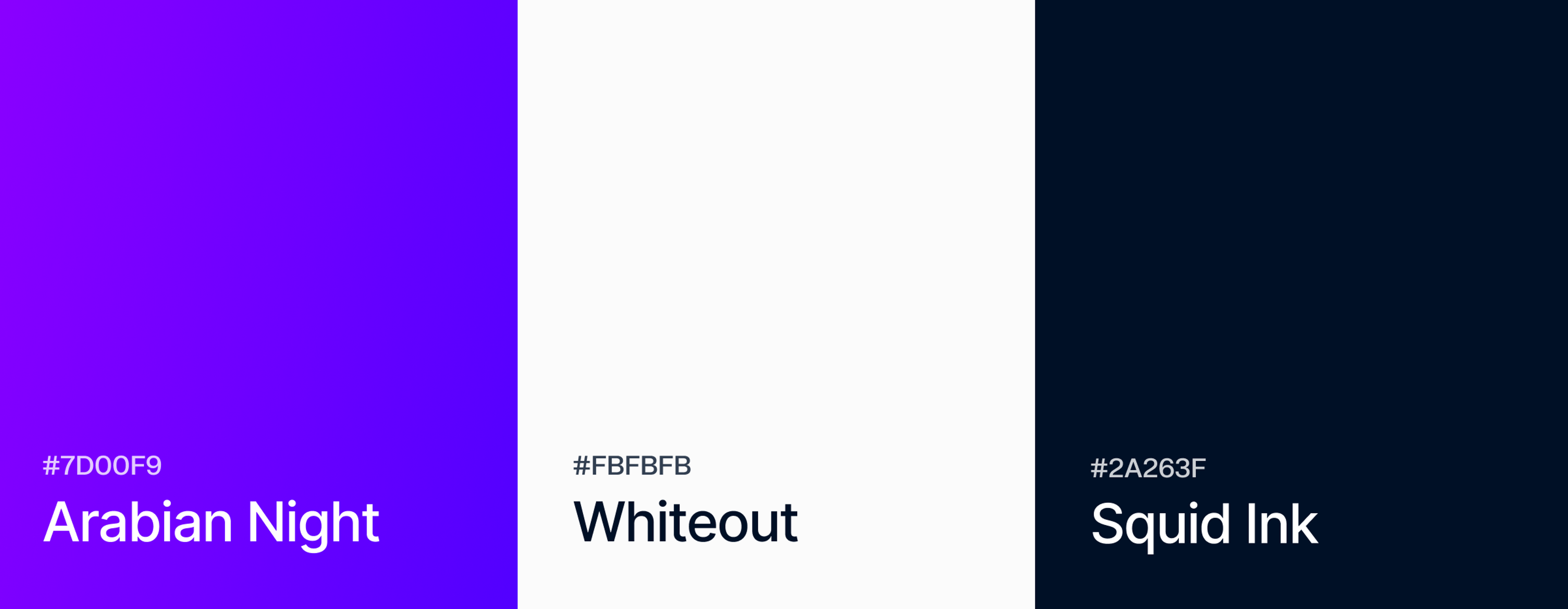

Zoogla provides remarkable financial opportunities for unbanked people in the UK, and we wanted to highlight this feat with a color palette, which sparks „ambition“, „power“, and „formality“.

The vibrant purple tones radiates an energetic feeling and signify the users’ independence, while the black accent brings forth a formal undertone. Those are then combined onto a clean white background to create an aesthetic yet professional environment, in which the user can neatly handle his finances.

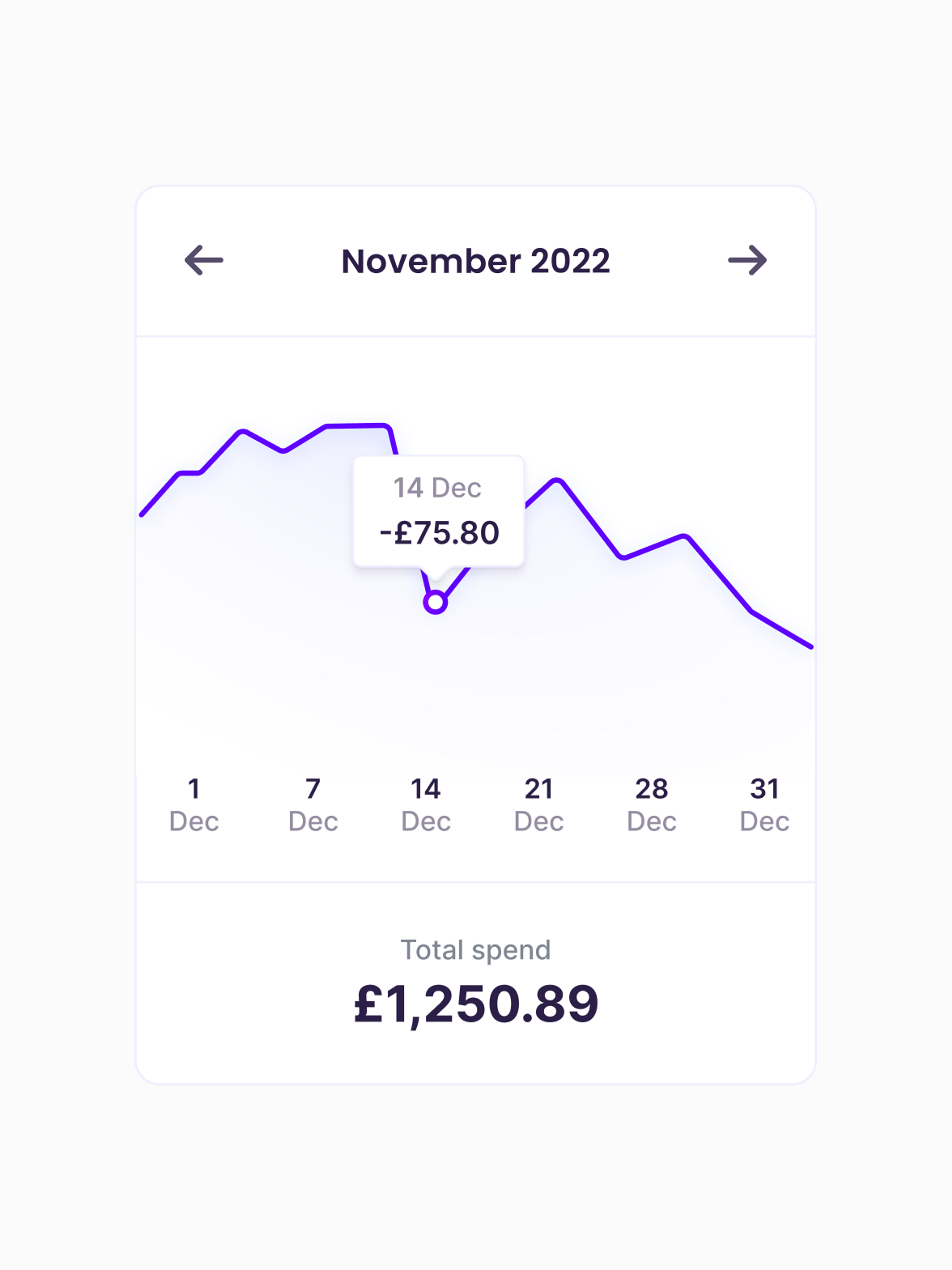

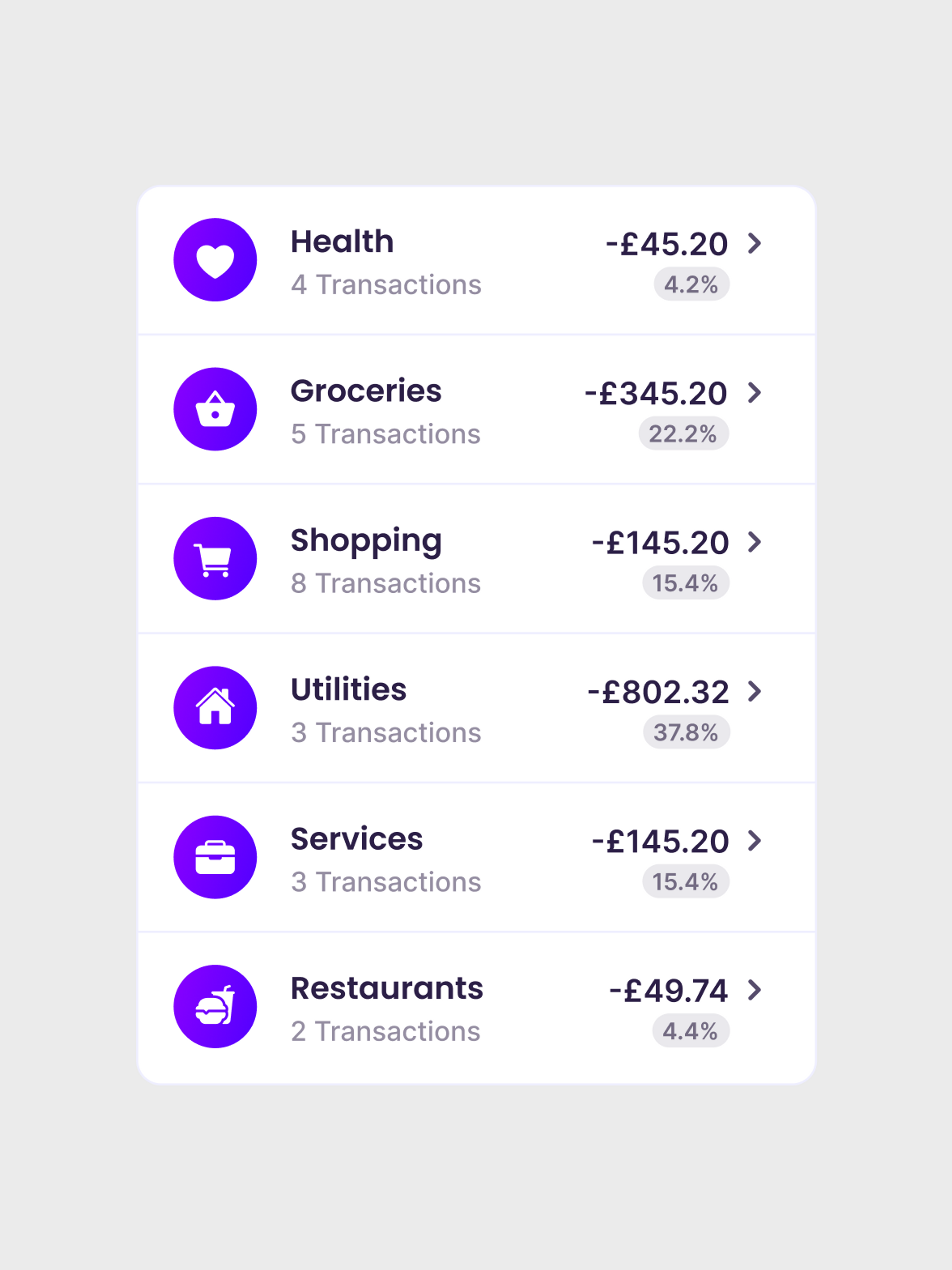

Track your spending with a sophisticated report tool

Zoogla provides their users with a detailed report page to help them track their spending. We built a graph that cleanly charts each expense taken during the month. To enhance the experience even further, we designed conclusively laid out icons for categories, to which the expenses are ascribed to. That way, the user has a clear understanding go how much he spend on what category.

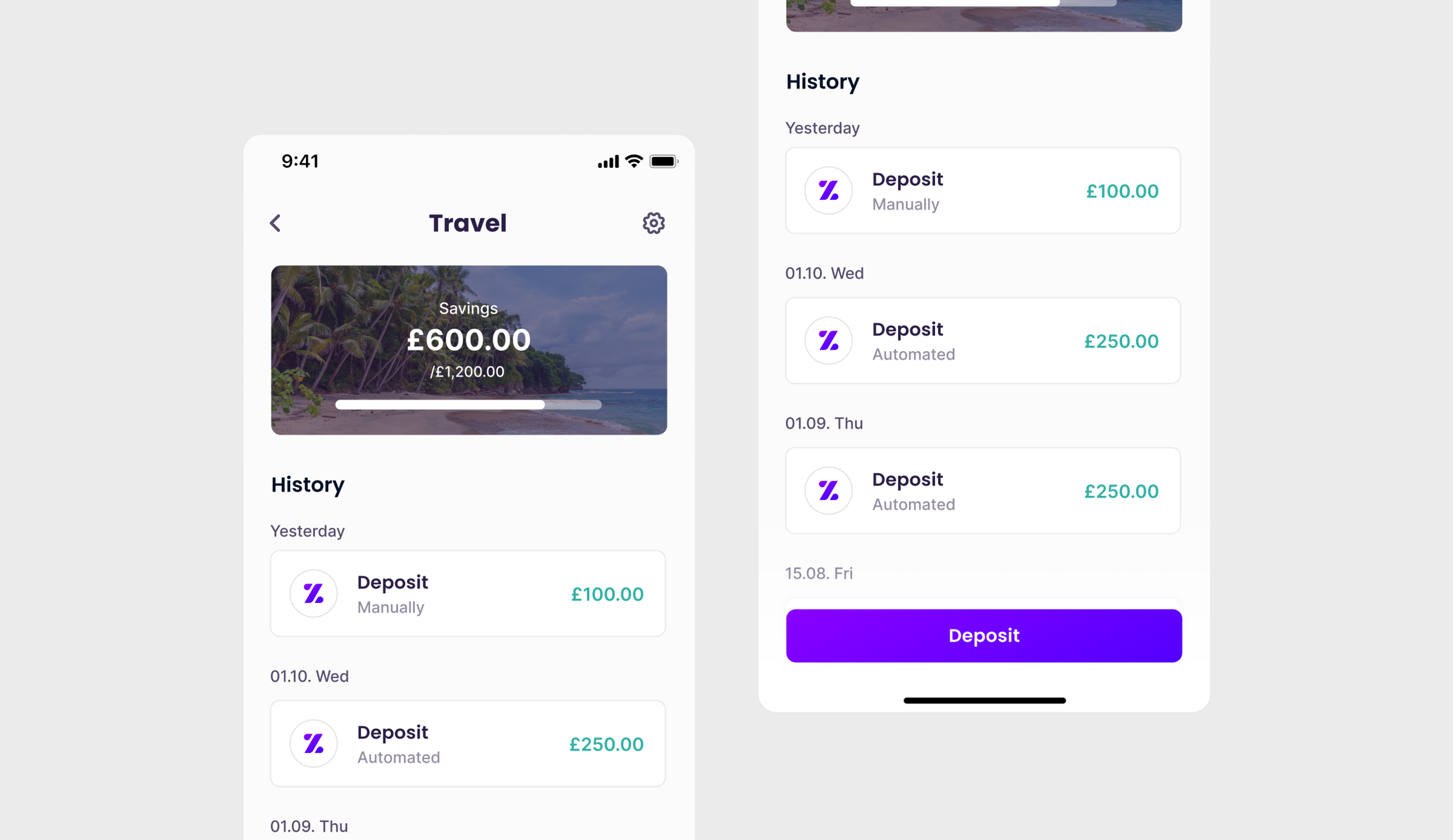

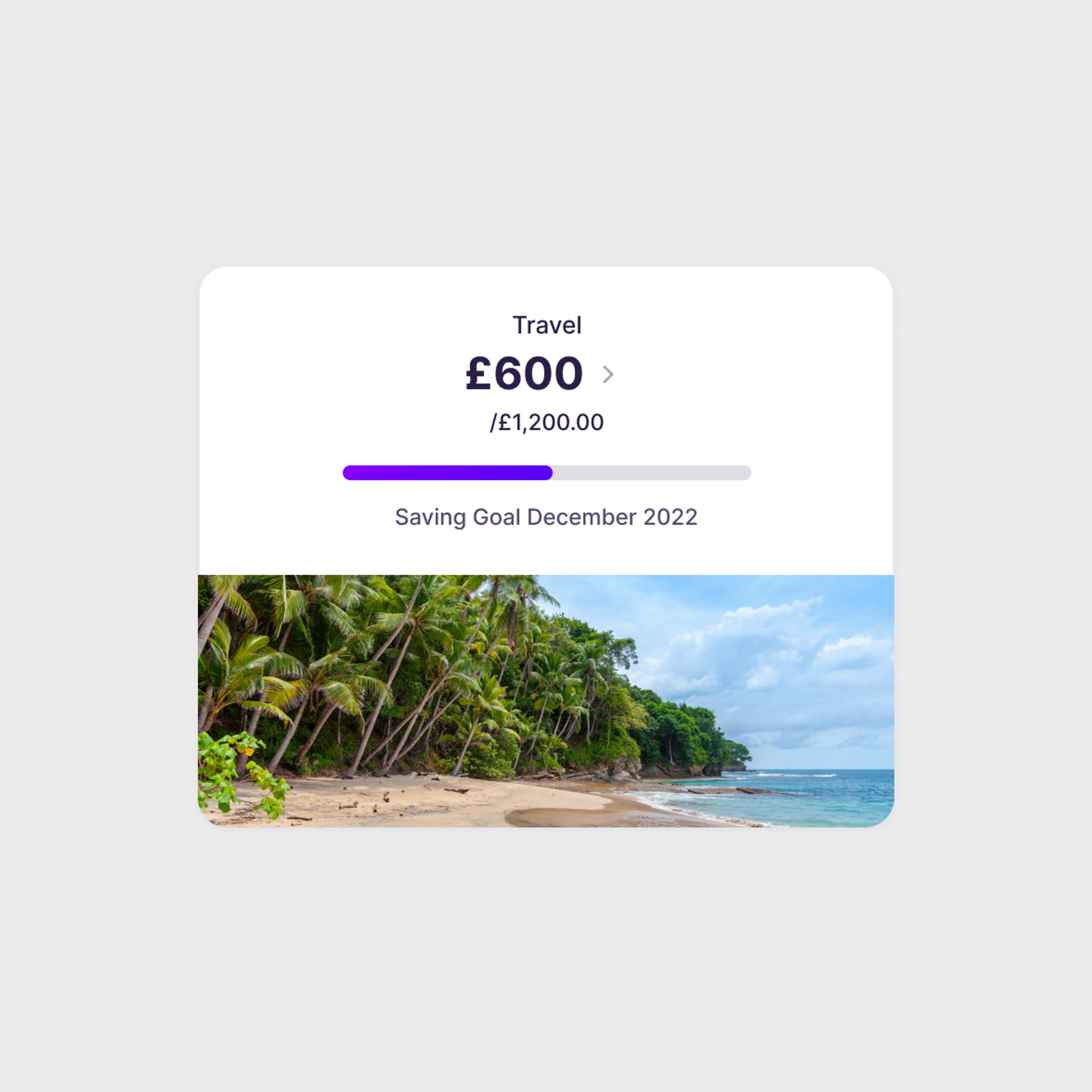

Save money effortlessly

Zoogla wants to encourage their users to save money. To achieve this, they enable them to create saving pots - each for a specific goal of their choice - without any bureaucratic hurdles. Users can configure these saving pots to align exactly with their specific needs, set distinct goals dependent on a date or amount, and create standing orders to achieve their savings goals and grow their wealth effortlessly. Once a goal has been reached, a pop-up window will visualize the user’s achievement, and further boost their sense of accomplishment.

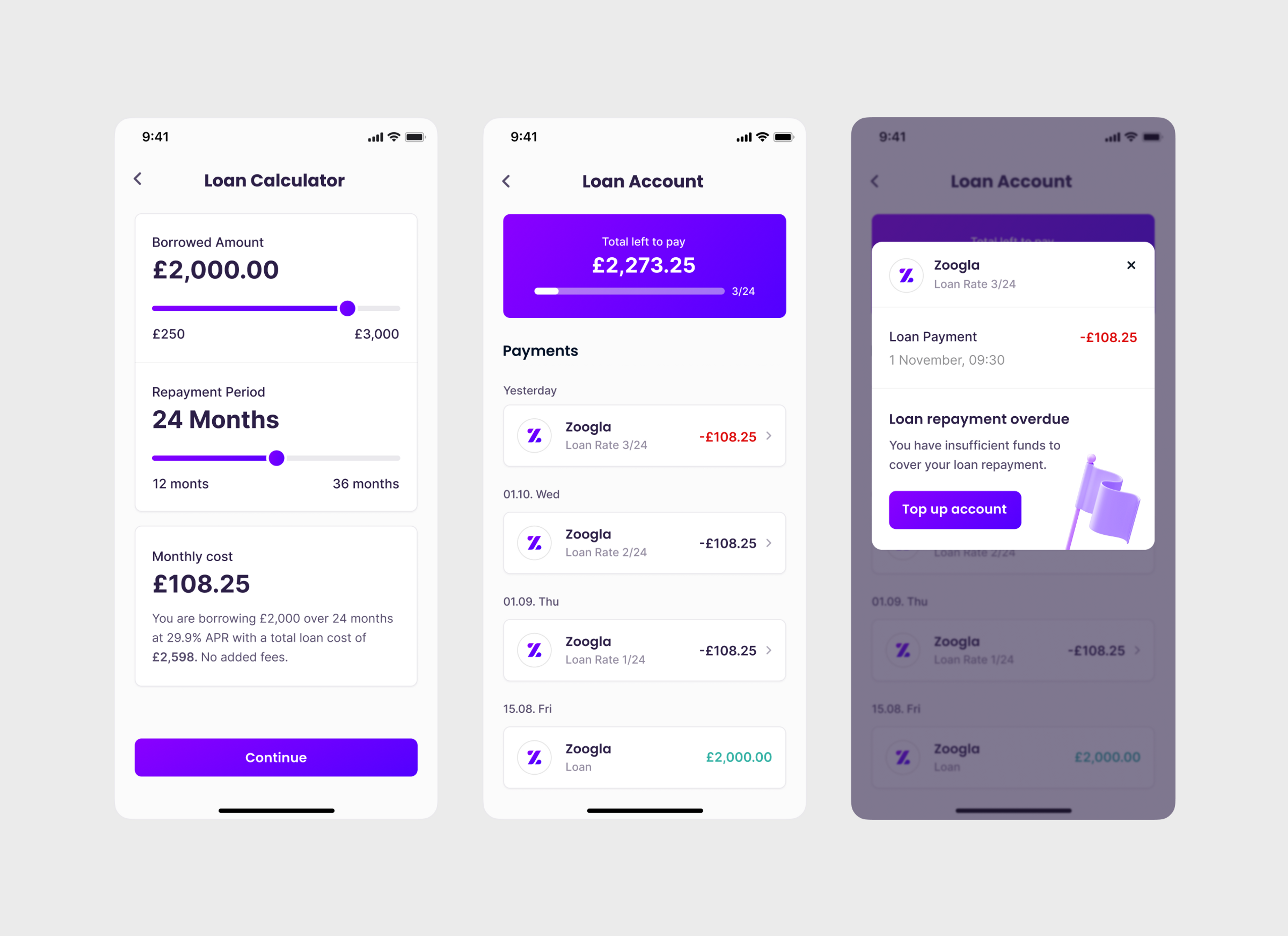

Take loans

As a banking app, Zoogla also offers loans to its customers. With a smoothly designed loan calculator users can easily determine, how much their credit will amount to and how long the repayment period will last.

In a second window, the user is provided with a history of the last credit payments, and a neatly placed summary, informing them on the amount due - and the number of payments they’ve already executed regarding that credit.

The Result

Zoogla provides a smart mobile banking solution for the financially excluded in the UK, enabling them to track their spendings, grow wealth, and build a credit score - thus, helping them build their financial future. With a new, revamped design, Zoogla can reach new highs in their mission to make banking available for everybody.

We at Fintory are proud to have contributed to Zoogla’s successful journey and look forward to any future projects they may have in mind.